In addition to save your business, having this found gives you safety, reduces stress and helps you stay more calm and focused on sell online courses and continue with your growth plan. The world of new business is unpredictable and to not waste your time, investment and having to give up your project in a short time, ensure a fund for emergencies, the survival kit of startups. “Almost every week I look at my personal and administrative finance”. “One time per month is not enough,” says Derek Flanzraich, from Greatist. Look for profit and for the break even is a way of gaining motivation, but you still need to focus on cash flow to make sure where you are standing, and it does not change when you begin to earn money. New entrepreneurs tend to focus too much on selling online courses and in the profit generated by it, and end up taking their concentration off the cash flow.

#Cashflow online how to#

After this point, the company begins to make profit.Ī well-structured financial planning helps you know when this moment will come, what does not impact on your cash flow, but provides guidance on how to spend your budget up to achieve it. This is the first goal of a startup, balancing expenses with revenue, i.e. Know when you will reach the break evenīreak even is the point at which revenue and expenses are equal. To help new entrepreneurs who want to sell online courses and maintain a stable cash flow, we prepared five tips on how to avoid shocks and keep your company in the market. However, many entrepreneurs do not have a good financial knowledge, what ends up unbalancing the balance of profit and expenditure and taking the business to bankruptcy.

#Cashflow online free#

With the help of computers, applications and free eLearning platforms as the, the number of online courses available on the internet continues to increase, and many people are beginning to see their efforts pay off. The growth of the eLearning market and the opportunities that it is generating not passed unnoticed by those who want to invest in own business, ensure an extra income or empower employees. Sell online courses: tips for controlling your cash flowĬreate and sell online courses is the bet of many professionals today.

#Cashflow online series#

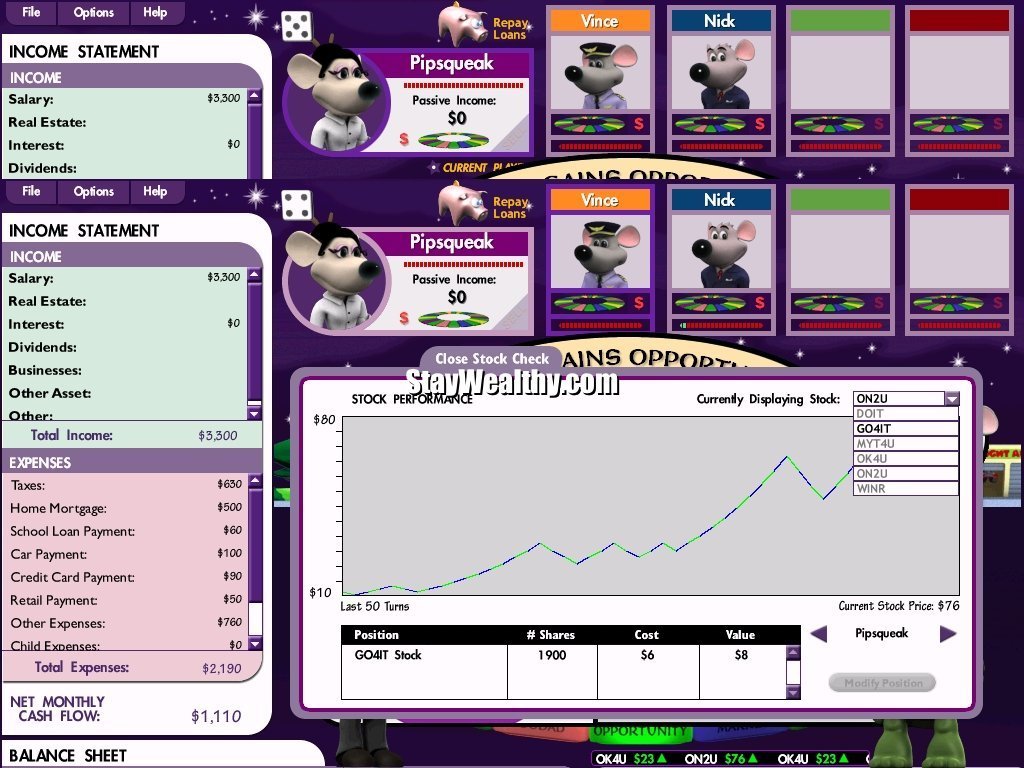

What follows is a series of shortcuts - simple ratios people use to estimate valuation quickly - and some variations.One of the biggest challenges for who is starting to sell online courses and want to turn this project into a profitable and solid business, is to know how to deal with the money purchased.

(and if you want you can also see the formula that makes this all work) So far we've gone over valuation theory and used one calculator So play it safe: if you want a meaningful answer that you can really understand, always assume that long-term growth is zero.) You'll find that you can force the math to give you any answer you want.

Keep the discount rate at eleven percent, and then see what happens to the theoretical stock value as you adjust the long-term growth rate from 10% to 10.9% to 10.99%. (If that didn't convince you, you can also see for yourself how some stock analysts come up with their lofty price targets: In particular, it's safest to set the long-term earnings growth to zero: if a company actually had constant positive growth forever it would become infinitely big. Give yourself a "margin of safety" by being conservative in your earnings assumptions. Its answers can be a few pennies off due to rounding.) (The "details" screen lets you alter an individual year's earnings if you wish. Return available on an appropriate market benchmark investment (like the S&P 500): You can find company earnings via the box below.Įarnings are expected to grow at a rate ofīefore leveling off to an annual growth rate of This calculator finds the fair value of a stock investment the theoretically correct way, as the present value of future earnings. Discounted Cash Flow Calculator for Stock Valuation

0 kommentar(er)

0 kommentar(er)